£5,000 &

£1,000,000

90%

approval

24

hours

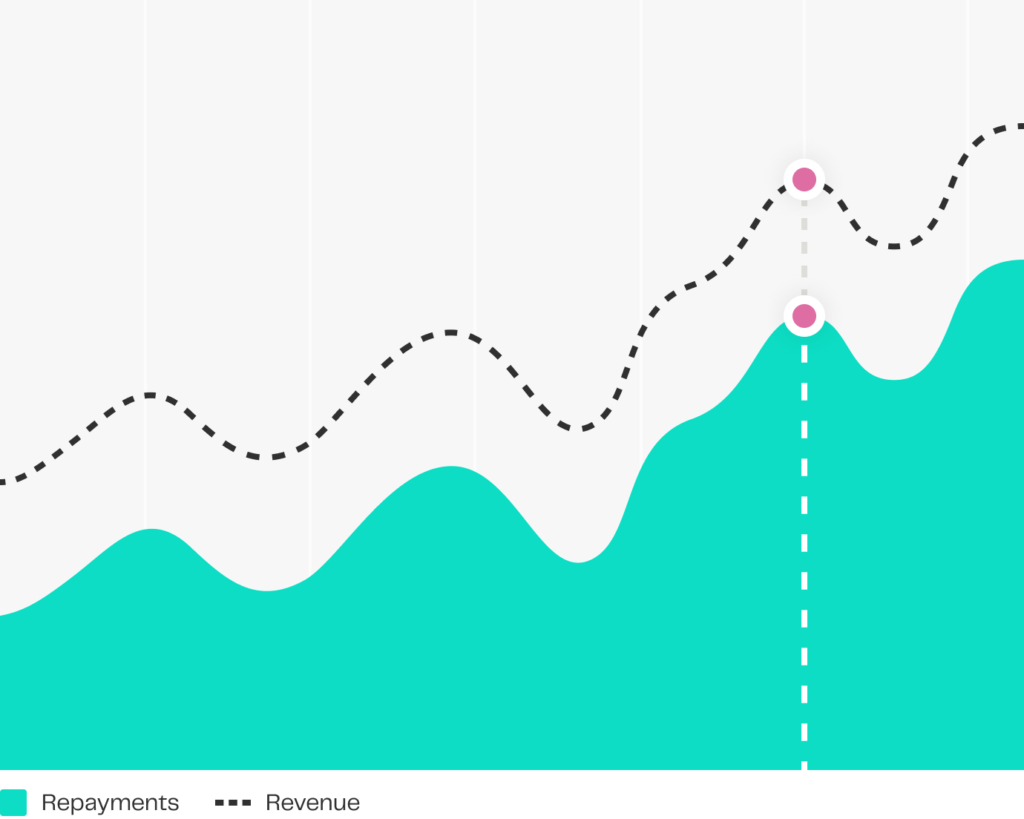

Unlike a traditional loan, repayments mirror

the ups and downs of your business.

Repayments are automatic and based on a small percentage of your monthly card sales. So when business is slow, repayments are low – and when business is good, you pay a bit more. Not only does this remove the stress of a traditional high street loan, it is also perfect for seasonal businesses.

We agree a fixed percentage of your credit and debit card sales to repay the business cash advance (typically between 5% and 15% of your card sales).

You sell to your customers on your credit and debit card terminals as usual.

The pre-agreed percentage is automatically deducted from your daily transactions at point of sale.

There is no change to the time it takes for you to receive the remaining money from your sales.

The daily amount deducted reduces the balance outstanding on the cash advance.

Collections stop automatically once the cash advance has been repaid in full.

Quick application process

Complete the application form. It takes less than 5 minutes!

Relationship manager

Be allocated a relationship manager to assist with any queries.

Approval in under 24 hours

Find out in up to 24 hours whether you’ve been approved or not.

Get your cash advance in days

Receive the funds direct into your business bank account within days.

Ditch the rigid loan structure and embrace flexible financing with Ariv Finance funding.

Ariv Finance funding is a merchant cash advance, a form of revenue based funding that enables you to quickly and easily raise between £5,000 and £1,000,000. Unlike a regular bank loan, there are no fixed monthly payments – you simply pay back a small percentage of your credit and debit card sales, meaning you only pay us back when your customers pay you.

There are no APRs, admin charges or late fees. So if you’re having a quiet month, your repayments automatically reduce, which helps you manage your cash flow

Skip the paperwork purgatory and financial obstacle courses. Ariv Finance takes the pain out of securing the capital you need to thrive. Ditch the elaborate business plans and forget about tying up your assets – with us, a merchant cash advance is accessible, not agonizing.

Speed, simplicity, and success:

Funding that bends, not breaks:

Ariv Finance is built for the realities of the entrepreneurial journey. We fuel your ambitions, not your paperwork nightmare. Apply today and experience funding the way it should be: fast, flexible, and focused on your success.

This version emphasizes the speed, ease, and flexibility of Ariv Finance’s funding process using a more dynamic and impactful language. It also highlights the control and freedom business owners retain with Ariv’s adaptable repayment system.

Forget the rigid shackles of traditional loans with their fixed, monthly burdens. Ariv Finance dances to the rhythm of your business, not a pre-programmed calendar. Ditch the predictable dips and embrace a dynamic path to success.

Say goodbye to the cash flow squeeze:

Embrace financial freedom, fuel your growth:

Ariv Finance isn’t just funding, it’s a cash flow revolution. Experience the joy of flexible repayments and watch your business flourish, one dynamic wave at a time. Apply today and let your financial tide rise with the rhythm of your success.

This rewrite injects a vibrant and dynamic tone, emphasizing the freedom and control Ariv Finance offers through its flexible repayment system. It highlights the contrast between the fixed rigidity of traditional loans and the adaptable flow of Ariv’s approach, positioning it as a liberating financial partner for businesses.

This will not affect your credit score.

Pay us back when your customers pay you

Funding in as little as 24 hours

One all-inclusive cost that never changes

Our acclaimed group is committed to delivering exceptional service to our clients, introducers, and partners. Get to know the individuals energizing ARIV FINANCE

We recognize the fluctuating nature of business. When swift access to funds is essential, revenue-based financing stands ready to provide the necessary assistance.

Empowering businesses through strategic financial backing to fuel their organic expansion and sustained growth initiatives.

Expanding business involves buying stock, equipment, hiring talent, and managing various costs for growth

Our funding process prioritizes speed, simplicity, and ease. There's no demand for business plans or collateral for a merchant cash advance. Post-funding, repayment processing occurs seamlessly, ensuring uninterrupted business operations. Applying takes mere minutes, securing approval within 24 hours (with a 90% approval rate). No collateral or business plans are necessary, and adaptable repayments align with your card sales.

Complete the application form. It takes less than 5 minutes!

Be allocated a relationship manager to assist with any queries..

Find out in up to 24 hours whether you’ve been approved or not.

Receive the funds direct into your business bank account within days.

“You made it so simple. My new site is so much faster and easier to work with than my old site. I just choose the page, make the change.”

Chief Marketing Officer

“You made it so simple. My new site is so much faster and easier to work with than my old site. I just choose the page, make the change.”

Chief Marketing Officer

“You made it so simple. My new site is so much faster and easier to work with than my old site. I just choose the page, make the change.”

Chief Marketing Officer

Explore our in depth guides to help business understand ARIV finance

We help you to better understand your competition-their strengths and weaknesses. We help you to create compelling sales presentations and marketing messages to better communicate your brand value.

The benefits of using business consulting and coaching services may include increased sales, new revenue streams and improved productivity. Benefits also include an opportunity.